Federal Mobility Budget

a step-up to more individual mobility needs, where you leave the choice at your employees.

Manage your mobility budget & offer via our software solution

What is the federal mobility budget?

The Federal Mobility Budget (FMB) allows employees to exchange their company car for a flexible, tax-efficient mobility package that offers smarter, greener choices that meet the needs of employees.

The budget is based on the cost of a company car to ensure accuracy and predictability, so that each employee receives a benefit equal to the value of a car. They can spend this at their own discretion on a wider range of sustainable options.

This approach keeps mobility management simple, compliant, and future-proof for both employers and employees.

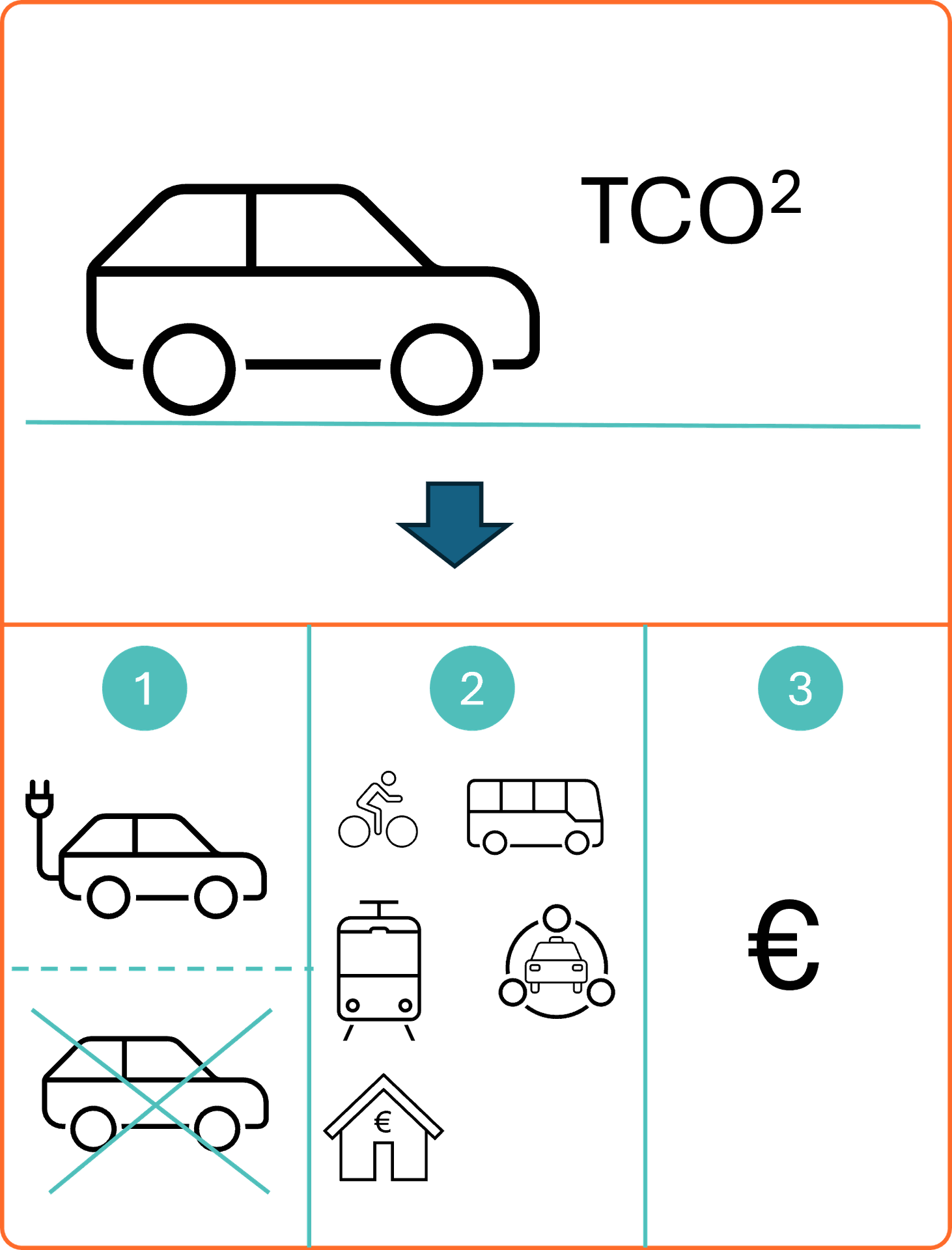

How do you calculate the mobility budget?

Based on the actual, historical total cost of ownership (TCO) of the employee's previous or assigned company car.

This includes all costs incurred by the employer: leasing or purchase, insurance, maintenance, fuel/electricity, taxes, and non-deductible expenses.

Uses a fixed formula, typically based on the annual lease or a percentage of the catalogue value, plus a variable component for private and commuting kilometres, multiplied by a standard cost per kilometre.

Our solution

Accurate en automized budget calculations

Whether you have already calculated budgets or require full automation, DELT Mobility adapts to your situation.

Budgets are always accurate and are automatically calculated for each employee.

Option 1: upload your own mobility budget

Alreday have your budget allocations?

Just imort them into DELT Mobility, and we automatically handle pro-rata adjustments and monthly distribution at onboarding and offboarding.

Everything stays precise and up-to-date.

Employee 1500

Users per role

Federal Mobility 100

Regular employee 1000

Company car 400

Option 2: Calculations done for your

Let us automatically calculate the federal mobility budget

Based on role, function and home-to-work distance, using the advanced TCO model. Every budget is generated within the official legal framework, with full automation and auditability built in.

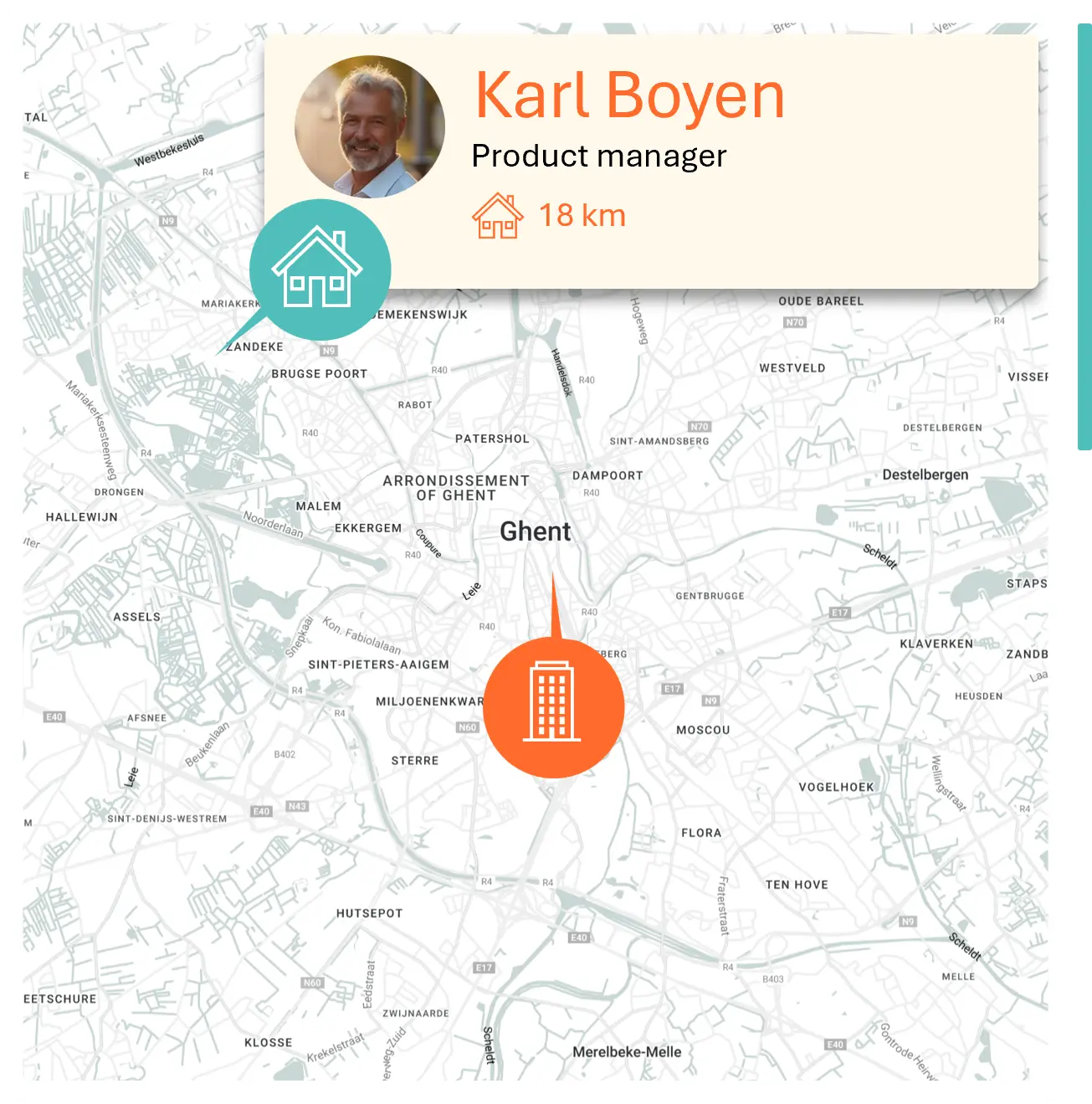

Karl Boyen

Karl Boyen

Product manager - 28 km 2.450

Pillar 1: Company car integrations

Employees can opt to keep a company car within the Federal Mobility Budget, provided it meets strict sustainability and budget criteria. All associated costs, such as leasing, insurance, maintenance, and fuel or electricity, are deducted directly from the employee’s total mobility budget. This ensures the benefit remains fair, transparent, and fully compliant with legal requirements

Car costs, always under control

All company car costs are tracked and deducted automatically. Empower responsible

car choices, support EV adoption, and keep mobility management simple and future-ready

Insights, centralized, mobility provider independent

We centralize the needed mobility data, independently which mobility suppliers you would select.

Forfaitary cost

Apply a fixed, forfaitary car cost for the full year, making budgeting predictable and straightforward, or match you lease contract with your drivers behavior through dynamic contract adapations.

Real Lease costs

Link directly to your lease provider for year-to-date lease costs, ensuring that the actual spent is always reflected in the mobility budget.

Fuel & EV charging

Integrate with major fuel and charging partners to automatically track and deduct fuel and EV charging expenses from the employees' budget.

Pillar 2 Sustainable mobility and housing

Sustainable mobility and housing sit at the heart of the Federal Mobility Budget, giving employees the freedom to use their budget for eco-friendly commuting and living options, like public transport, cycling, shared mobility, or housing near the workplace. This approach is designed to support greener choices, reduce fleet costs, and help organisations meet their environmental and compliance goals, while offering employees real flexibility and value.

Every expense, from rent to bike leases and car rentals, is automatically checked and kept within your company’s policy limits. With full automation across all eligible options, you deliver flexible benefits, maintain oversight, and ensure every transaction is validated and controlled.

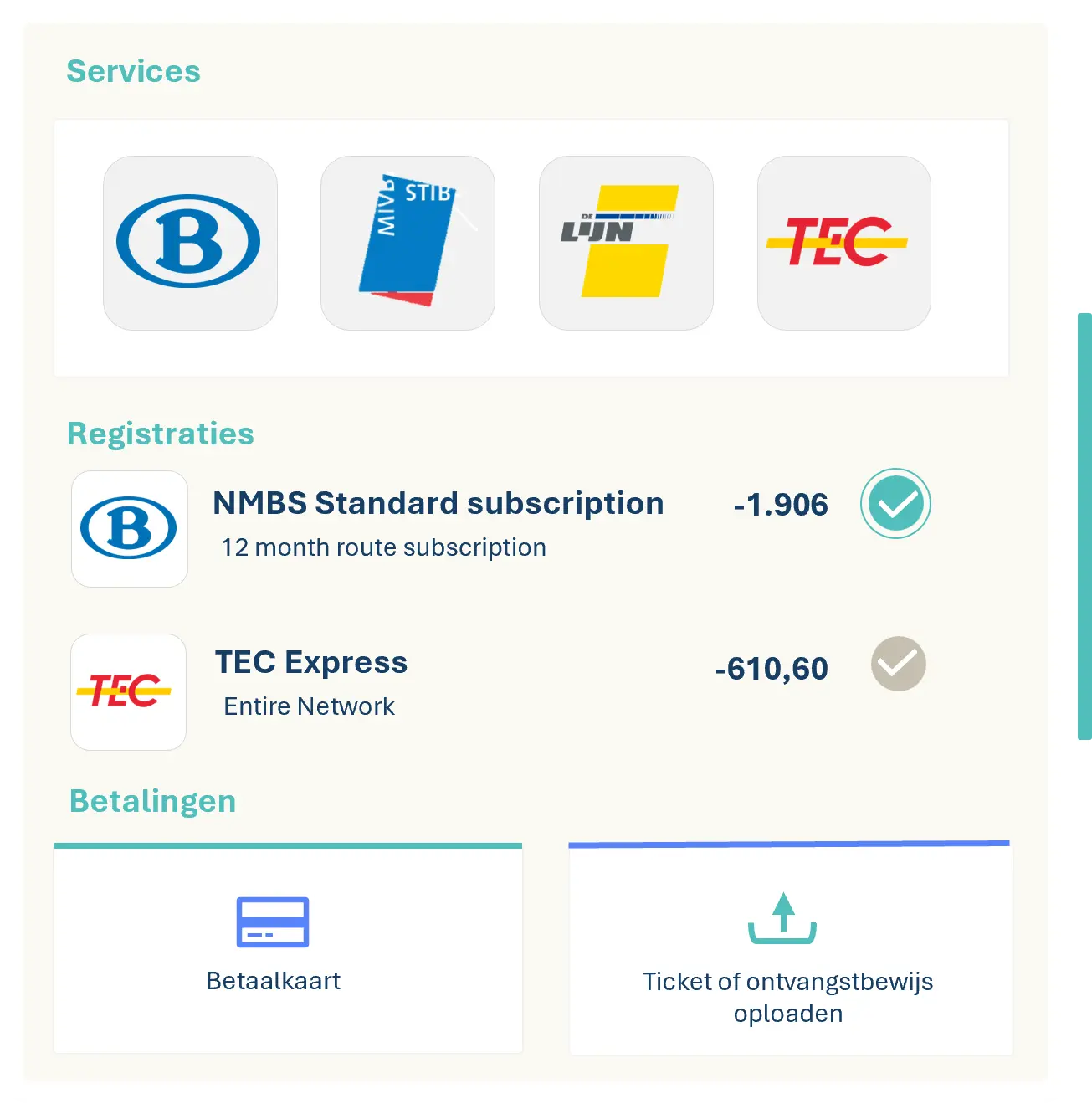

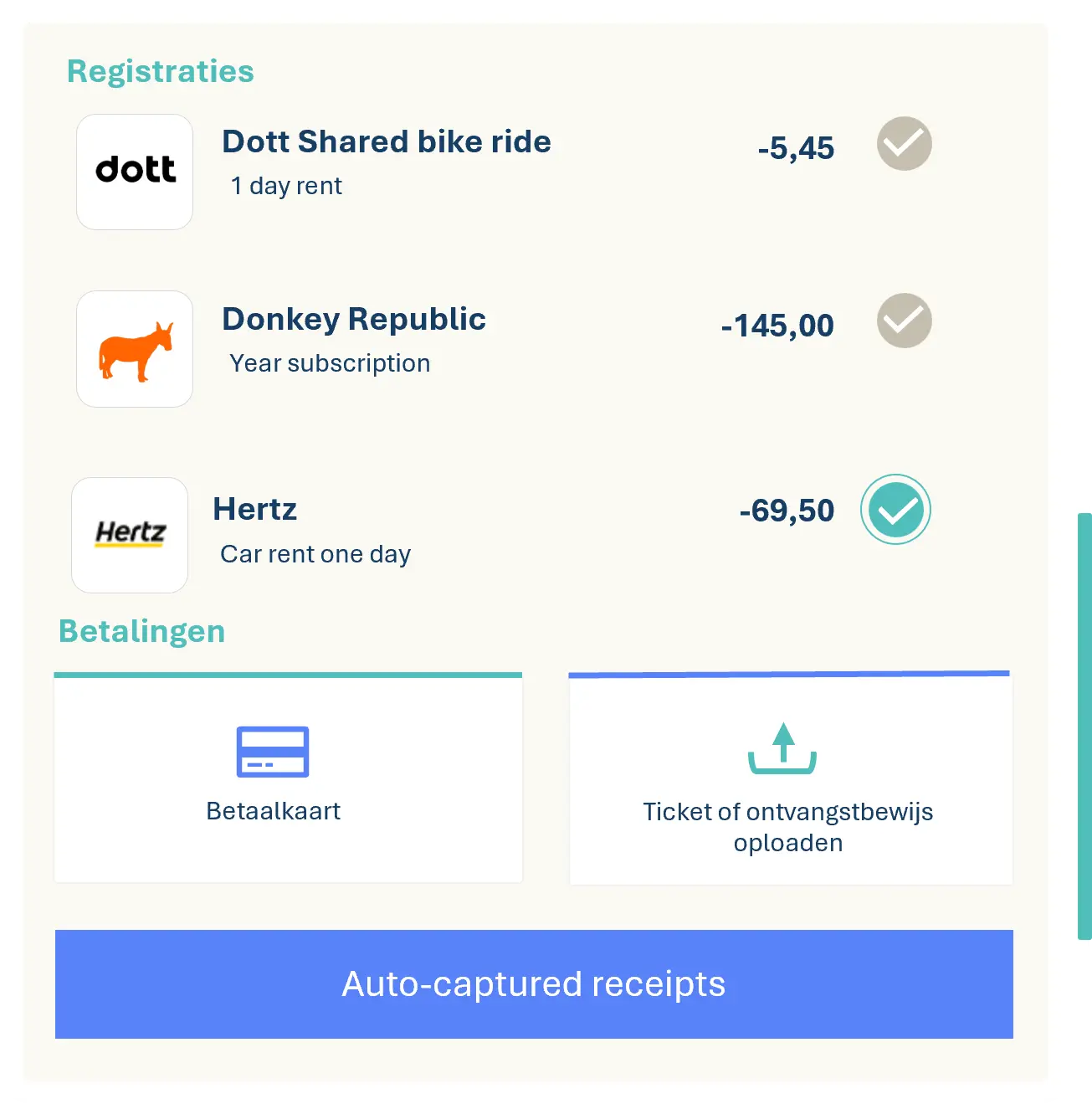

Registrations

NMBS Standard subscription -1.906,00

NMBS Standard subscription -1.906,00

Decathlon Bike & accesories -832,90

Decathlon Bike & accesories -832,90

Housing: rent February -975,00

Housing: rent February -975,00

Rent car: 1 day -69,50

Rent car: 1 day -69,50

Expense evaluation

All expenses are automatically validated using AI-based checks and manual reviews, ensuring every claim meets legal and policy requirements.

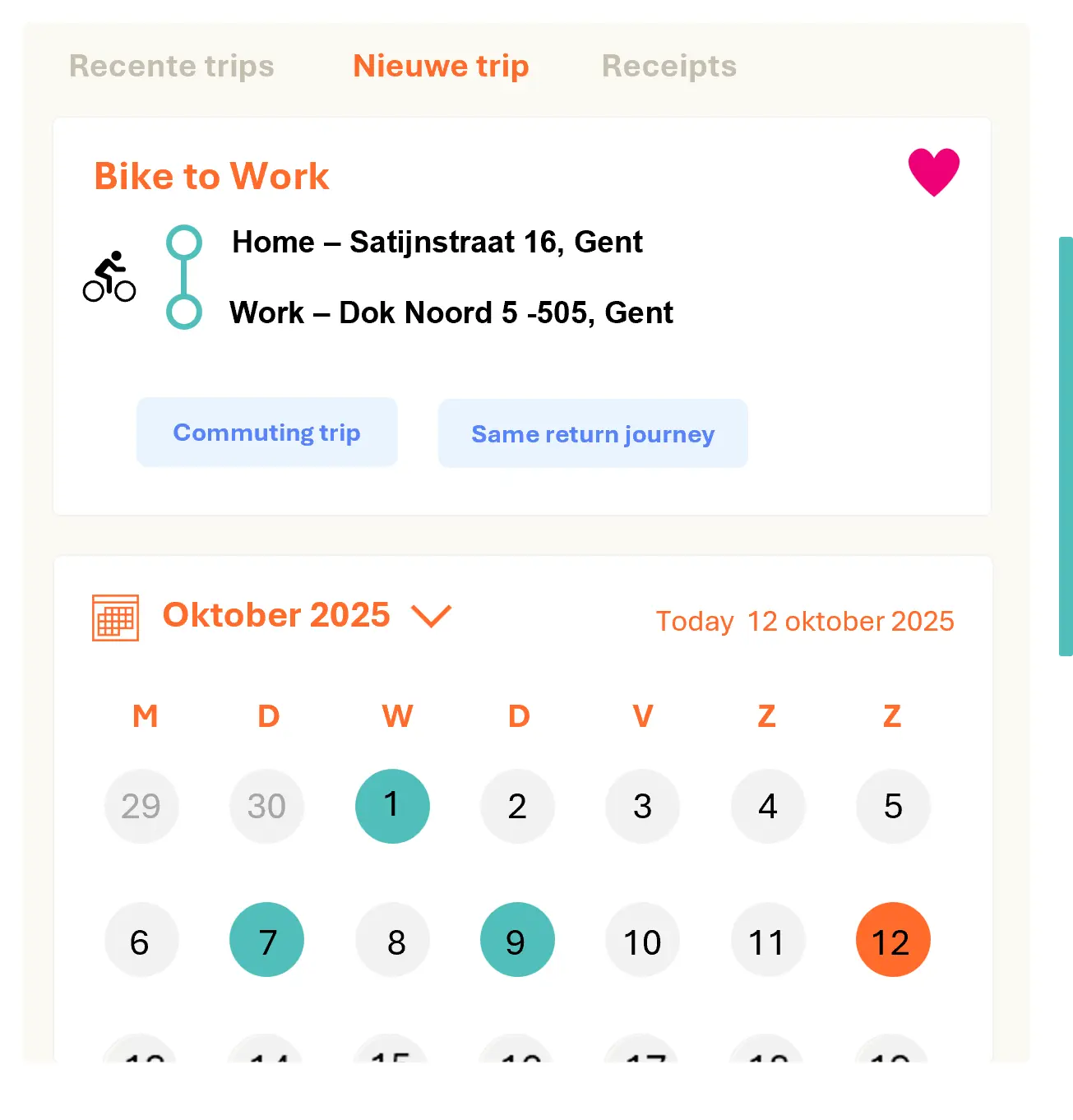

Mobility ticketing & payment card

Employees can use mobility ticketing options and a DELT-issued payment card for real-time transactions, eliminating the need for uploads or reimbursements.

voor real-time transacties op te volgen. Dit sluit het manueel werk uit om betalingsbewijzen op te laden en terugbetalingen te verwerken.

Payroll integrations & exports

Approved expenses are reimbursed via payroll, fully integrated with the most important HR payroll providers. Full transparancy for the end-user, and full auditability.

For all eligible mobility options

Housing

Employees can allocate their budget to rent or mortgage payments within 10 km of their workplace, or if working remotely at least 50% of the time. DELT Mobility automatically verifies addresses, contracts, and payment proofs, ensuring every transaction is fully compliant with legal requirements

Cycling

DELT Mobility covers the broadest range of cycling use cases compliant with the Federal Mobility Budget, including purchase, leasing, accessories, and repairs.

Public transport

Employees pay for public transport and shared mobility across the EU with the DELT card—no receipts needed. Other expenses can be uploaded manually and are automatically validated through AI-powered compliance checks.

Shared Mobility

Employees access shared cars, bikes, or rentals using the DELT card or auto-captured receipts, no admin needed. AI checks compliance, including 30-day rental rules, and payroll handles reimbursement.

Pillar 3 Cash out -Our solution

No mobility budget goes unused. Any remaining balance at year-end is automatically tracked, calculated, and paid out, giving employees extra value while your business maintains full compliance and control.

Real-Time budget tracking

Every euro of the mobility budget is tracked throughout the year, so employees and employers always know exactly what’s available.

Automatic year-end Processing

Any remaining balance is calculated and processed automatically, eliminating manual checks and administrative work.

Seamlsess payroll integration

The payout is handled directly through payroll in January, ensuring a smooth, compliant, and timely transfer for every employee.

Why leading organisations opt for DELT Mobility

AGILE

Fast deployement, ready in no time

+35 OPTIONS

integrated in one platform

Automatisation

administration lowered to the bare minimum

24/7

Managing mobility, anytime, everwhere

100%

policy compliance, automated audit trails

Independent

expertise, accurate market insights

User friendly features

Increasing satisfaction of your employees: access to a single, user-friendly portal and mobile app to manage every aspect of their mobility budget with ease

REAL sustainble choices

easier to choose for green commuting

Quick Registration

of bike commutes and eligible trips

Effortless registration

of receipts and supporting documents

Seamless payments

for all mobility, shared and public transport

Real-time tracking

of reimbursements, directly linked into payroll

Live budget overview

employees always know where they stand

Enterprise-grade Security & privacy

ISO 27001 & SOC II certified. All data stays in the EEA. SSO, role-based access,

full encryption & audit trails - full compliance. Zero admin full control.

Frequently asked questions

Yes. The law sets clear limits on the Federal Mobility Budget: • Must not exceed 20% of the employee’s gross annual salary • Annual budget must fall between €3,055 and €16,293 (2024 index) • Holiday pay and end-of-year bonuses are excluded from the gross wage calculation

No. The law only requires at least one option in Pillar 2. You don’t need to offer the full range of mobility services. Start small and scale gradually. Examples of minimal setups:

Just public transport

only housing cost reimbursement

DELT Mobility gives you full control over what’s offered, per group, per policy, or per role.

Alleen openbaar vervoer

Alleen vergoeding van woonlasten

DELT Mobility geeft u de volledige controle over wat er wordt aangeboden, per groep, per policy of per functie.

No. It’s optional. Most employers simply offer housing reimbursements for employees living within 10 km of their main work location. DELT Mobility checks this automatically and approves or declines requests based on address data. The >50% home-working condition can be added, but it’s not required by law.

Start small. Grow smart. Most employers launch with Pillar 2 + Pillar 3 using the most common and high-impact options: 🏠 Housing reimbursement (<10 km) 🚆 Public transport 🚲 Buy-a-bike Then scale gradually: Add bike leasing Offer company car + EV-charging integration in Pillar 1 Vaigo supports you at every step—with templates, automation, and best-practice playbooks.

Not yet—but it’s almost likely coming. The Belgian government announced in the 2025 “paasakkoord” that the FMB would become a mandatory option for employees with a company car. The final legislation is not yet published, but it’s wise to prepare. Vaigo helps you roll out a future-proof, legally compliant setup today